Investment Insights

About Investment Insights

Delivering results, reliability, & rock solid dependability.

We develop creative, comprehensive and sustainable engineering solutions for a future where society can thrive.

The Investor

Project Acquisition $38,800,000.00 USD

CPT Equipment $12,900,000.00 USD

Investment @ $38,800,000.00 USD

Investor ROI @ 14.43% $44,400,000.00 within (4) years

(4) Year Buyout (Short-term) $5,600,000.00

Annualized ROI @ 3.43%

Paid Quarterly over (4) years $2,775,000.00

Call Center

Call us for more information or business inquiry.

+1-719-352-4341

Why Choose Us

Real People. Real Work. Real Rewards.

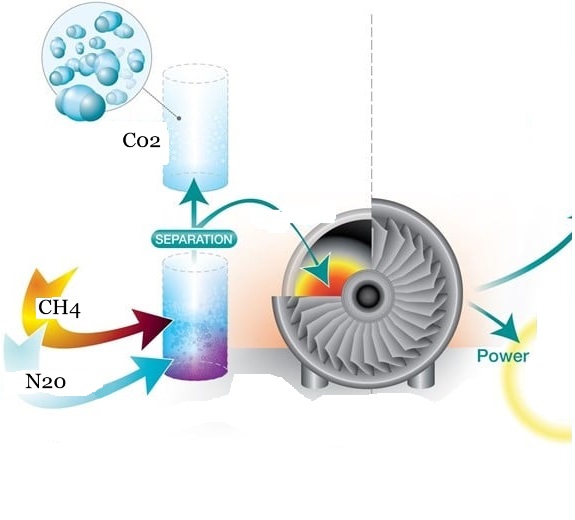

Why not use the Greenhouse Emission to our benefit rather than just storing them.

Project 1 tab:

- Efficiently submit necessary permits to begin testing the (4) largest oil and gas sites so as to convert them into the GIP (Green Initiative program) through VRU While setting up an DRU from the wellhead and increase oil production.

- Within the first (3-6) months after purchase establish (1) DRU at (3) of the Well sites to help increase oil and gas production from (40%) to (62%), while generating a secondary revenue stream through Data Center technology, increasing the profit margin (x2) and recycling emissions reducing cost.

- Test and establish the first sites fitted with the VRU and DRU within the first (4-6) weeks after purchase. Review cost for potentially moving forward with (2) crews to shorten project time-frames, if possible as most oil and gas sites will require VRU and DRU installation to increase oil and gas production safely, as well as the amount of Data technology production.

- Over the course of said (3-6) months secure city and landowner permission to develop gas lines to a single or (2) rally point/’s to converge lesser producing gas volume wells into a single or (2) source thus increasing oil production at those well sites and increasing overall oil production to (92%) while increasing Data Center production through combustion generation and reducing site emissions by (90%) with a goal of (100%).

Project 2 tab:

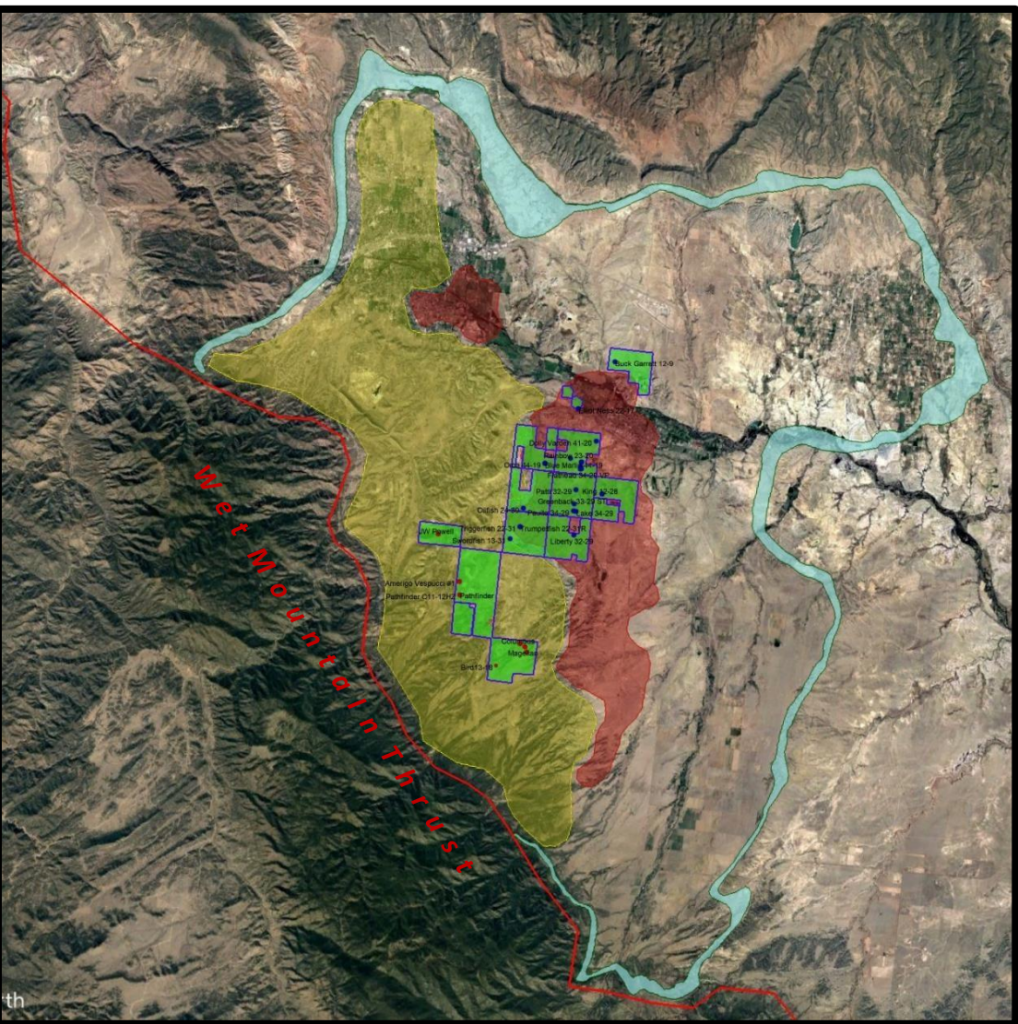

- Project (2) will require a conjoined site; the wells are mid-level producers with minimal gas on the wellhead. This reduces the available gas volume that would be required on its own to power (MRUs) in a single location. To maximize profits and a stronger ROI key is to conjoin the their (11) wellsite’s or a bulk thereof. Goal with this acquisition will be to add positive volume to Cryptic Petroleum’s Oil production while minimizing the addition to the Blockchain process.

Project 3 tab:

- Project 3 holds the largest wellsite count which will increase Cryptic Petroleum holdings on the Basin, its Oil production, and its Blockchain revenue stream. By consuming Javernick’s (80) wellsite’s with the infrastructure of CO2/CH4 capture at each wellsite along the Basin landscape it is believed that this will hold a key impact of Greenhouse emissions on the immediate area. It is believed by recycling the surrounding environments carbon/methane emissions the overall impact will reduce Greenhouse by 56-79% across the Basin.

- The Javernick Petroleum acquisition holds another potential resource; Javernick’s holdings potentially include a drilling service division. This division routinely performs repairs, testing, drilling operations along the Basin.

Market opportunity overview

$250MM

Opportunity to acquire Oil companies and operate on the Basin including the gas pocket. With future acquisitions in Texas, Oklahoma, Wyoming, Montana, New Mexico, Northern Colorado, and others as it may apply.

Byproduct profits on over (168) well site via the use of Blockchain technology.

$245MM

Few competitors are even currently considering these approaches to emission control oil production. Nor are many of them aware of the technology or their potential uses within the oil and gas industry.

This is our current upper hand.

Market opportunity comparison

$4MM

Acquisition of the key wellsite’s would be crucial to our revenue goal.

Revenue in Oil over 12 months after key Acquisitions. Revenue is based off (15) Sites only.

$44MM

In Blockchain rewards at (15) Sites with a minimum of (X) number of Data Centers. Revenue over 12 months after key Acquisitions.

$409.7BN

Our Largest competitor is Exxon-Mobil

Exxon-Mobil is currently one of the other companies utilizing Blockchain technologies to generate a byproduct revenue.

Traction

Forecasting for success

Five-year financials action plan

Acquisition Timeline may vary, and are subject to adjust to financial backing

| Revenue is subject to Market Prices for both Bitcoin and Oil |

| Loss factor of 5% or market, whichever is greater |

| Gas value is subject to Royalties |

| NOI is net revenue before mortgage interest, amortization and depreciation. |

| Valued off known Gas volumes |

| Factor starts on (15) out of (39) known wells |

| Site are subject to change in Gas volume/Miner quantity/Container quantity |

| Oil factor does not include the injection of (EOR) |

| Blockchain revenue | ||||||

| April 7th, 2025 | 5 Year P&L | |||||

| 2025 | 2026 | 2027 | 2028 | 2029 | ||

| Income | ||||||

| Gross Revenue | $ 44,750,909 | $ 60,006,869 | $ 72,567,825 | $ 75,156,255 | $ 89,416,775 | |

| Losses @ 5% | 5% | $ 2,237,545 | $ 3,000,343 | $ 3,628,391 | $ 3,757,813 | $ 4,470,839 |

| Net Collected Revenue | $ 42,513,363 | $ 57,006,526 | $ 68,939,434 | $ 71,398,442 | $ 84,945,936 | |

| Expenses | ||||||

| Management fee @ 5% | 5% | $ 2,125,668 | $ 2,850,326 | $ 3,446,972 | $ 3,569,922 | $ 4,247,297 |

| Salaries & wages | $ 1,200,000 | $ 1,260,000 | $ 1,323,000 | $ 1,389,150 | $ 1,458,608 | |

| Travel | $ 75,000 | $ 78,750 | $ 82,688 | $ 86,822 | $ 91,163 | |

| Vehicle leases | $ 22,500 | $ 23,625 | $ 24,806 | $ 26,047 | $ 27,349 | |

| Rents | $ 230,000 | $ 241,500 | $ 253,575 | $ 266,254 | $ 279,566 | |

| Repairs & Maintenance | $ 135,000 | $ 141,750 | $ 148,838 | $ 156,279 | $ 164,093 | |

| Grounds, landscaping & snow | $ 6,000 | $ 6,300 | $ 6,615 | $ 6,946 | $ 7,293 | |

| Utilities | $ 575,000 | $ 603,750 | $ 633,938 | $ 665,634 | $ 698,916 | |

| Insurance | $ 15,000 | $ 15,000 | $ 16,500 | $ 16,500 | $ 17,000 | |

| legal and acct | $ 1,200 | $ 1,260 | $ 1,323 | $ 1,389 | $ 1,459 | |

| Federal Taxes | $ 289,680 | $ 434,520 | $ 434,520 | $ 506,940 | $ 506,940 | |

| Total expenses | $ 4,675,048 | $ 5,656,781 | $ 6,372,773 | $ 6,691,883 | $ 7,499,684 | |

| Net Operating Income (or EBITDA) | $ 37,838,315 | $ 51,349,744 | $ 62,566,660 | $ 64,706,559 | $ 77,446,253 | |

| Net Operating Income (or EBITDA) | $ 37,838,315 | $ 51,349,744 | $ 62,566,660 | $ 64,706,559 | $ 77,446,253 | |

| Oil & Gas Revenue | $ 4,335,012 | $ 5,645,080 | $ 5,678,900 | $ 5,990,455 | $ 6,467,890 | |

| Net Annual Total | $ 42,173,327 | $ 56,994,824 | $ 68,245,560 | $ 70,697,014 | $ 83,914,143 |

740,223+

Company From All Around The World trust on Cryptic Petroleum Technologies for awesome project

Project Realize

Expertise

staff members worldwide

Awards Won